Exploring QuickBooks Property Management: A Comprehensive Guide

Delving into the realm of QuickBooks property management, this guide offers a detailed exploration of how this software can revolutionize the way property management tasks are handled. From streamlining operations to enhancing financial reporting, QuickBooks proves to be a valuable tool for property management businesses.

As we navigate through the intricacies of QuickBooks in property management, you'll uncover essential tips and insights to optimize your business processes effectively.

Overview of QuickBooks Property Management

QuickBooks offers a range of functionalities tailored specifically for property management businesses, helping streamline various tasks and processes involved in managing properties effectively.

Functionality of QuickBooks in Property Management

- Track rental income and expenses: QuickBooks allows you to easily record and monitor rental payments, expenses, and other financial transactions related to your properties.

- Manage tenant information: Store tenant details, lease agreements, and payment histories in one place for quick access and reference.

- Generate financial reports: Utilize QuickBooks to generate detailed financial reports, such as profit and loss statements and balance sheets, to gain insights into your property portfolio's performance.

- Automate rent reminders: Set up automated rent reminders and notifications to ensure timely rent collection and reduce the risk of missed payments.

Benefits of Using QuickBooks for Property Management

- Increased efficiency: By centralizing property management tasks and automating processes, QuickBooks helps save time and effort, allowing property managers to focus on other aspects of their business.

- Improved accuracy: With features like automatic data syncing and financial reporting, QuickBooks minimizes the risk of errors in financial records and ensures accurate reporting.

- Better financial management: QuickBooks provides a comprehensive overview of your property finances, helping you make informed decisions and optimize your property investments.

- Enhanced organization: Keep all property-related information organized and easily accessible within QuickBooks, facilitating better organization and management of your property portfolio.

Setting Up QuickBooks for Property Management

To effectively set up QuickBooks for property management purposes, follow these key steps and utilize specific features tailored for property management needs.

Customizing Chart of Accounts

- Create specific accounts for rental income, property expenses, maintenance costs, and other relevant categories.

- Utilize sub-accounts to track income and expenses for each property individually.

- Customize account names and numbers to align with your property management structure.

Setting Up Rental Properties

- Create individual customer profiles for each tenant or property unit.

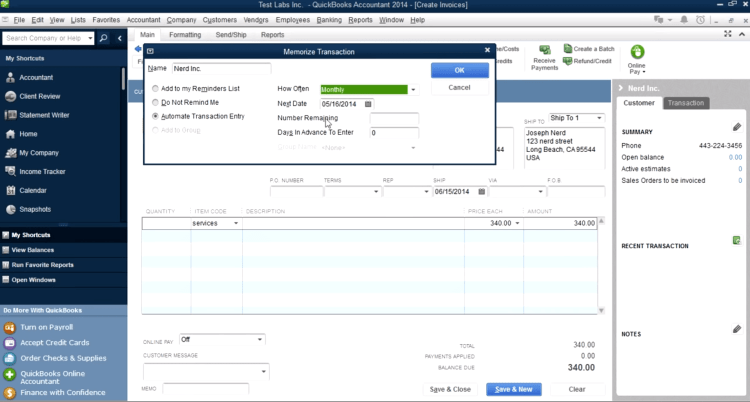

- Set up recurring invoices for rent payments and lease terms.

- Utilize Classes or Locations feature to track income and expenses by property.

Tracking Expenses and Maintenance

- Enter property expenses such as repairs, utilities, and property taxes in the appropriate accounts.

- Use the Attachments feature to link receipts and invoices to transactions for easy reference.

- Set up automatic reminders for maintenance tasks and scheduled payments.

Managing Properties in QuickBooks

Managing properties in QuickBooks involves inputting property details, tracking them effectively, organizing property-related transactions, and analyzing property performance through reporting capabilities.

Inputting Property Details and Tracking

- Input property details such as address, type, size, and other relevant information into QuickBooks.

- Assign unique identifiers to each property for easy tracking and identification.

- Utilize custom fields in QuickBooks to capture specific property details that are important for your management needs.

- Regularly update property information to ensure accuracy and completeness in your records.

Organizing Property-Related Transactions

- Categorize transactions related to properties under specific accounts or classes in QuickBooks.

- Use sub-accounts or subclasses to further segregate transactions based on different properties or property types.

- Create custom transaction categories or labels to easily differentiate property-related expenses, income, and other financial activities.

- Implement a standardized naming convention for accounts and transactions to maintain consistency and clarity in your records.

Reporting Capabilities for Property Performance Analysis

- Generate property-specific reports in QuickBooks to analyze key performance indicators such as occupancy rates, rental income, expenses, and profitability.

- Utilize customizable reporting features to track property maintenance costs, repairs, and other related expenses over time.

- Compare performance metrics across different properties to identify trends, opportunities for improvement, and areas of concern.

- Create dashboards or visual representations of property performance data to facilitate quick decision-making and strategic planning.

Tenant Management Using QuickBooks

Managing tenant information and payments within QuickBooks is essential for property managers to keep track of rent payments, lease agreements, and communication with tenants efficiently. QuickBooks provides various tools and features to streamline the tenant management process, making it easier for property managers to stay organized and maintain accurate records.

Tracking Rent Payments and Expenses

- One method of tracking rent payments in QuickBooks is by setting up recurring invoices for each tenant. This allows you to automatically generate and send invoices to tenants for their monthly rent.

- Another way to track rent payments is by recording each transaction manually in the system. This provides more control and allows you to customize the payment details for each tenant.

- For expenses related to property maintenance or repairs, you can categorize and track them separately in QuickBooks to get a clear overview of your financials.

Automation Options for Tenant Communication

- QuickBooks enables you to schedule automated rent reminders to be sent to tenants before the due date. This helps reduce late payments and ensures tenants are aware of their financial obligations.

- You can also set up automatic notifications for lease renewals or other important dates to keep both you and your tenants informed and up-to-date.

Financial Reporting and Analysis

Financial reporting and analysis play a crucial role in the success of property management businesses. QuickBooks offers robust tools to generate specific financial reports tailored to the needs of property managers. Let's dive into how QuickBooks can help in analyzing cash flow, expenses, and income to ensure the financial health of your property management business.

Generating Financial Reports in QuickBooks

- QuickBooks allows property managers to create detailed financial reports such as profit and loss statements, balance sheets, and cash flow statements.

- These reports provide insights into the financial performance of each property, allowing managers to make informed decisions based on accurate data.

- Customizable reporting features in QuickBooks enable property managers to track specific metrics relevant to their business, such as rental income, maintenance expenses, and occupancy rates.

Analyzing Cash Flow, Expenses, and Income

- QuickBooks helps property managers analyze cash flow by tracking income from rent, security deposits, and other sources, as well as monitoring expenses like maintenance, repairs, and utilities.

- By categorizing transactions accurately, property managers can gain a clear understanding of their cash flow and identify areas where expenses can be optimized to improve profitability.

- Comparing income and expenses over time using QuickBooks reports allows property managers to identify trends, forecast future cash flow, and make strategic financial decisions.

Importance of Accurate Financial Reporting

- Accurate financial reporting is essential for property management businesses to maintain transparency, comply with regulations, and attract investors or stakeholders.

- Timely and precise financial reports enable property managers to assess the financial health of their properties, identify potential risks, and take proactive measures to address any issues.

- By leveraging QuickBooks for financial reporting and analysis, property managers can streamline their financial processes, improve efficiency, and ultimately enhance the overall performance of their property management business.

Integrations and Add-Ons for QuickBooks Property Management

When it comes to managing properties efficiently, integrating third-party add-ons with QuickBooks can streamline your processes and enhance your overall property management experience.

Third-Party Integrations for QuickBooks Property Management

There are various third-party integrations available that can complement QuickBooks for property management. Some popular options include:

- Property management software like Buildium or AppFolio that seamlessly syncs with QuickBooks to automate tasks such as rent collection, lease tracking, and maintenance requests.

- Online payment processors like PayPal or Stripe that can be integrated with QuickBooks to facilitate secure and convenient rent payments from tenants.

- CRM tools like Salesforce or HubSpot that can be linked to QuickBooks to manage tenant relationships and track communication effectively.

Benefits of Integrating QuickBooks with Property Management Software

Integrating QuickBooks with property management software offers several benefits, including:

- Increased efficiency by automating repetitive tasks and reducing manual data entry.

- Improved accuracy in financial reporting and analysis by ensuring all property-related transactions are captured in one centralized system.

- Enhanced visibility into property performance and profitability through real-time data synchronization between QuickBooks and property management software.

Tips for Choosing the Right Add-Ons for QuickBooks Property Management

When selecting add-ons to complement QuickBooks for property management, consider the following tips:

- Identify your specific needs and objectives to determine which features are essential for your property management operations.

- Research different add-ons and compare their functionality, pricing, and user reviews to find the best fit for your business.

- Ensure compatibility and seamless integration with QuickBooks to avoid any technical issues or data discrepancies.

Concluding Remarks

In conclusion, QuickBooks property management offers a robust solution for property managers looking to streamline operations, enhance tenant management, and gain valuable insights through financial reporting. By leveraging the functionalities of QuickBooks tailored for property management, businesses can achieve greater efficiency and success in managing their properties.

FAQ Corner

How can QuickBooks streamline property management tasks?

QuickBooks automates processes like rent collection, expense tracking, and financial reporting, saving time and improving accuracy.

What are some key features of QuickBooks essential for property management?

Features like income tracking, expense categorization, and property performance analysis tools are crucial for managing properties efficiently.

How does QuickBooks help in managing tenant information and payments?

QuickBooks allows easy input of tenant details, tracks rent payments, and offers automation options for communication and reminders.

What financial reports can QuickBooks generate specific to property management?

QuickBooks can generate reports on cash flow, expenses, income, and property performance analysis to aid in decision-making.

Which third-party integrations enhance QuickBooks for property management?

Integrations with property management software, payment processors, and reporting tools can extend QuickBooks' functionality for property managers.